PM Kisan Samman Nidhi

Department of Agriculture, Cooperation & Farmers Welfare

Ministry of Agriculture & Farmers Welfare

How to apply for New Farmer Application Entry?

Enter Aaadhar Number

Visit: PM-Kisan Amount Status

Department of Agriculture, Cooperation & Farmers Welfare

Ministry of Agriculture & Farmers Welfare

PM-KISAN Scheme 2020

- PM Kisan is a Central Sector Scheme with 100% funding from the govt of India.

- It has become operational from 1.12.2018.

- Under the scheme, income support of 6,000/- per annul in three equal installments are going to be provided to small and marginal farmer families having combined landholding/ownership of up to 2 hectares.

- The definition of the family for the scheme is wife, husband, and minor children.

- State Govt and UT administration will identify the farmer families which are eligible for support as per PM Kisan scheme guidelines.

- The fund is going to be directly transferred to the bank accounts of the beneficiaries.

- The first installment for the period 1.12.2018 to 31.03.2019 is to be provided in the financial year itself.

- There are various Exclusion Categories for the scheme.

Who are not eligible for PM KISAN Scheme?

Scheme Exclusion

The following categories of beneficiaries of upper economic status shall not be eligible for benefit under the scheme.

1.All Institutional Landholders.

2. Farmer families that belong to one or more of the following below categories:

i) The Formers and present holders of constitutional posts

ii)The Former and present Ministers/ State Ministers and former/present Members of State/LokSabha/ RajyaSabha Legislative Assemblies/ State Legislative Councils, former and present Mayors of Municipal Corporations, former and present Chairpersons of District Panchayats.

iii) All serving or retired officers and employees of Central/ State Govt Ministries /Departments/Offices and its field units Central or State PSEs and Attached Autonomous/offices Institutions under Govt as well as regular employees of the Local Bodies

(Excluding Multi Tasking Staff(MTS) /Group D/Class IV employees)

vi)All retired/superannuated pensioners whose monthly pension is 10,000/- Rs or more

(Excluding Multi Tasking Staff(MTS) / Group D/Class IV employees) of the above category

v) All Persons who paid tax in the last assessment year

vi) Professionals like Lawyers, Chartered Accountants, Doctors, Engineers, and designers registered with Professional bodies and completed the profession by undertaking practices.

How to apply for New Farmer Application Entry?

New Registration Form

Step 1: Visit: https://www.pmkisan.gov.in/RegistrationForm.aspx

Enter Aaadhar Number

Enter Mobile number that linked to aadhar

Select State

Enter Image Text

Click on Send OTP

Click on Submit

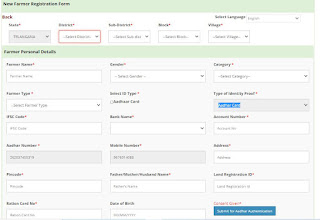

Step 3: New Farmer Registration form

Fill the application

Here we can fill in all details easily, someone will get confused with Land Registration ID.Click on Consent Given* Submit for Aadhar Authentication - you will get like Yes, Aadhar Authenticated Successfully!!!!!

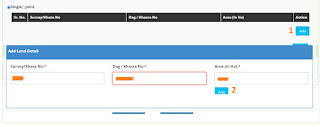

Step 4: Add Land DetailsEnter Survey/Katha NumberEnter Dag / Khasra No.Enter Area (In Ha)Click on Add

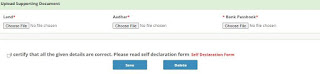

Step 5: Upload - Land Passbook, Aadar Card, and Bank Passbook

Note: Need to upload with PDF format only

1. Land Passbook - Upload Should be less than 100 KB and PDF format2. Aadhar Card - Upload should be less than 50 KB and PDF format 3. Bank Passbook - Upload should be less than 100 KB and PDF formatUpload all 3 documents and Click on Check Boxand Click o Save

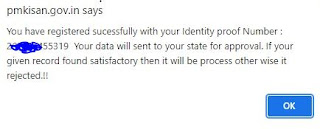

Step 6: After Click on Save ButtonYou have registered successfully with your identity proof number: XXXX XXXX XXXX your data will be sent to your state for approval. if your given record is found satisfactory then it will be processed otherwise it is rejected.!!

Check Status for PM Kisan amount credited or not?

1. Land Passbook - Upload Should be less than 100 KB and PDF format

Visit: PM-Kisan Amount Status

No comments:

Post a Comment